Zhike | Has Kolon Pharma, which has been consecutively rising for three years in the transformation to innovative drugs, still been underestimated?

Author | Huang Yida

Editor | Zheng Huaizhou

In the past three years, the pharmaceutical market has been in a long-term winter. For investors, the only reason to buy pharmaceutical stocks seems to be the low valuation. However, Kelun Pharmaceutical can be said to be an exception among pharmaceutical stocks. Its stock price has continued to rise in the past three years. Compared with the overall pharmaceutical market, it not only has shown an independent market trend but also has frequently reached new historical highs.

From a business perspective, Kelun Pharmaceutical is the leader in the two industries of large-volume infusion and antibiotic intermediates. At the same time, it has also been making great progress in the field of innovative drugs in recent years. It is a typical example of the transition from generic drugs to innovative drugs. The quality and quantity of its innovative drug pipeline can be comparable to those of the leading domestic innovative drug companies. Moreover, Kelun Pharmaceutical's innovative drugs are mainly based on ADC, a new and popular technology, making it more topical in the capital market.

Figure: Stock price trend of Kelun Pharmaceutical; Source: Wind, 36Kr

So, what is the core logic for investors to continuously buy Kelun Pharmaceutical in recent years? What are the important points of Kelun Pharmaceutical's innovative drugs?

01 Large-Volume Infusion: Steady Growth and Leading Gross Margin

The so-called large-volume infusion, that is, a large-capacity injection, usually refers to a liquid sterilization preparation with a capacity of ≥50ml and directly infused into the body through intravenous drip. As one of the most basic treatment methods, in the case of a high penetration rate, the expansion of the market scale is mainly driven by the natural growth of the demand side.

Looking at the long-term logic of the future demand growth of large-volume infusion, it is mainly the long-term infrastructure construction of the medical system and aging; the short-term logic mainly depends on the relevant demand growth driven by the staged epidemics, such as influenza. From the perspective of the marginal change in demand, although the short-term demand growth may fluctuate to a certain extent in a specific period, but the long-term elasticity is relatively small, and the overall industry growth is slow.

In terms of the competitive landscape, the CR4 of the domestic large-volume infusion market is as high as 88% (in 2023), and Kelun Pharmaceutical has long maintained the top position in the market, with a market share of about 46% in the same period. In an oligopolistic competitive market, small and medium-sized enterprises are gradually being eliminated, and the competition intensity is not high. Therefore, the leading enterprises are relatively stable. Considering the business format with limited demand elasticity, Kelun Pharmaceutical's large-volume infusion business highlights a sense of stability.

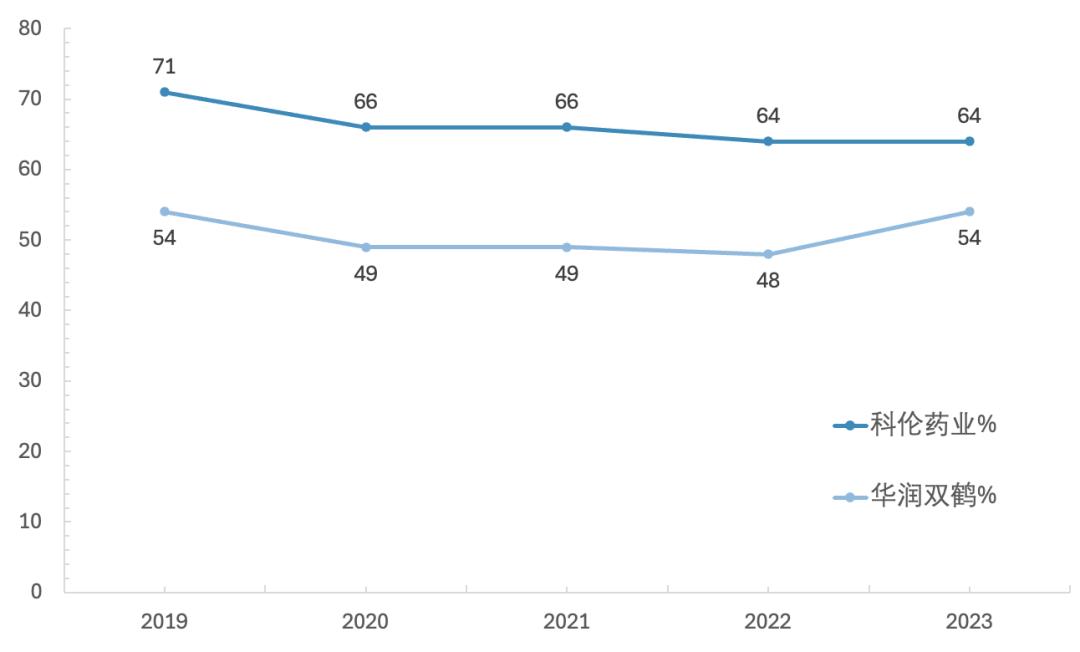

The highlight of the large-volume infusion business is that its profitability has long led its competitors. The financial data in the past six years shows that the gross margin of Kelun's large-volume infusion business is 10 - 17 percentage points higher than that of China Resources Double-Crane. The core reasons for Kelun Pharmaceutical's leading gross margin are, on the one hand, the long-term product structure optimization, and the proportion of high value-added products is gradually increasing. On the other hand, it has a strong cost control ability, including the cost advantage brought by the integrated supply chain, the lower production cost of the new production capacity after process improvement, and the further compression of costs through packaging material upgrading.

Figure: Gross margin of Kelun Pharmaceutical and China Resources Double-Crane in the large-volume infusion business; Source: Wind, 36Kr

The impact of the centralized drug procurement on Kelun Pharmaceutical's large-volume infusion is relatively more positive, although the price of the集采 varieties is under pressure, the unit price of the large-volume infusion products is relatively low, so the impact of the price reduction is much milder. Moreover, winning the集采 bid is conducive to improving the market coverage and reducing the sales expenses at the same time, and cost control supports the net profit. From the perspective of Kelun's own product structure, due to the relatively low price of the large-volume infusion products and the relatively high long-distance transportation cost, which is not conducive to the national集采, the proportion of products outside the集采 standard is about 80% currently, so the negative impact of the集采 price reduction on Kelun Pharmaceutical's large-volume infusion business is relatively small.

02 Antibiotic Intermediates: Performance Elasticity of Existing Business

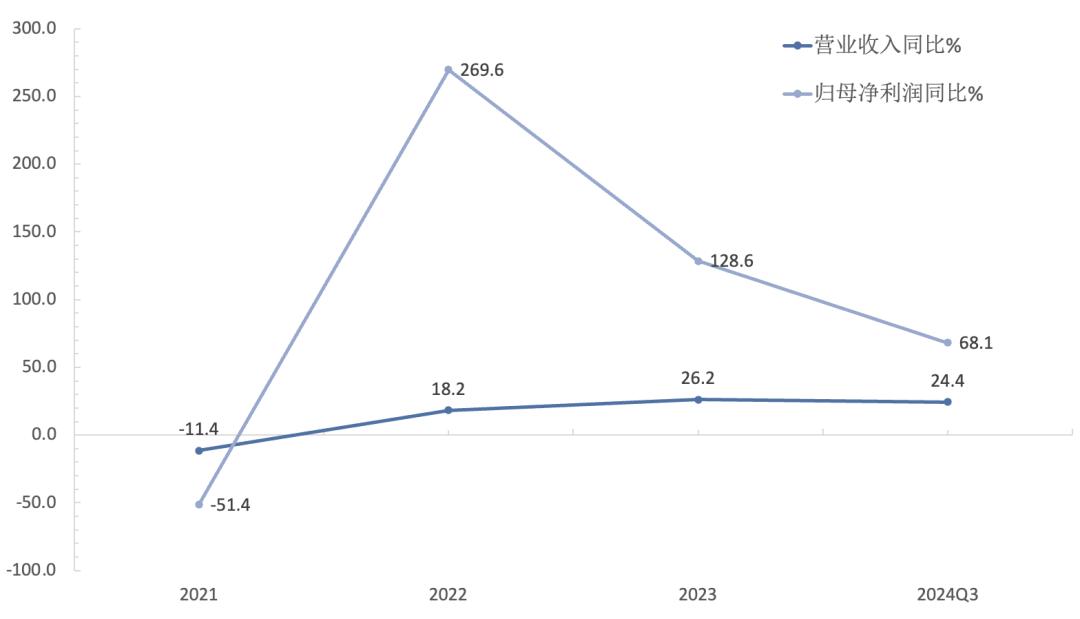

Large-volume infusion is the basic business of Kelun Pharmaceutical, and the antibiotic intermediate business is the performance elasticity of Kelun Pharmaceutical's existing business. Since 2022, the subsidiary Chuanning Biotechnology has maintained double-digit growth in the revenue side. With the gross margin steadily increasing and the period expenses continuously controlled, the net profit rate attributable to the parent company has also achieved a steady increase. Therefore, the improvement of profitability driven by cost optimization is the main driving force for the performance growth of Chuanning Biotechnology in recent years, while the decline in the net profit growth rate is mainly affected by the increase in the performance base.

Figure: Revenue and net profit growth rate attributable to the parent company of Chuanning Biotechnology; Source: Wind, 36Kr

The antibiotic industry has some similarities with the large-volume infusion industry, that is, the overall industry growth is slow, and the main driving force is also the natural growth of clinical demand. Therefore, the demand for the upstream antibiotic intermediate industry is also growing slowly simultaneously. From the perspective of the core subdivided varieties of Kelun Pharmaceutical, such as erythromycin thiocyanate, cephalosporin intermediates, etc., in general, the market concentration is relatively high and the competitive landscape is stable. Kelun Pharmaceutical, as the leader of antibiotic intermediates, has also maintained a steady growth in the corresponding product market segments.

The reason why the competitive landscape of antibiotic intermediates is good is that, on the one hand, this type of business has a certain technical barrier, and the long-term upstream and downstream cooperative relationship also makes the supply chain tend to be stable. On the other hand, under the heavy pressure of environmental assessment, the environmental protection barrier of antibiotic intermediates is relatively high, and the difficulty of new project approval is increasing. It is precisely because of the existence of technical and environmental protection barriers, coupled with the slow growth of downstream demand, which is not conducive to the entry of new players, so the market share of old players is also relatively stable.

The second growth curve of Kelun Pharmaceutical's antibiotic intermediate business is synthetic biology, and the related products that have been laid out are applied in the fields of pharmaceutical intermediates, health care product raw materials, cosmetic raw materials, biological substrates, agricultural feed, flavors and fragrances, etc. From the perspective of the capacity release cycle, the pharmaceutical intermediates, health care product raw materials and some cosmetic raw materials have been commercialized, and the production time of other products is mostly concentrated in 2024 - 2025. In the future, with the sales volume of synthetic biology products increasing, it will boost the performance growth of Kelun Pharmaceutical.

03 Innovative Drugs: Entering the Harvest Period

Both large-volume infusion and antibiotic intermediates are existing businesses, and the future expectations of Kelun Pharmaceutical mainly depend on innovative drugs. The biggest highlight of Kelun Pharmaceutical's innovative drugs is the ADC of Kelun Botai. In our previous Zhike article "Is the Surging Kelun the Last Fig Leaf of the Pharmaceutical Sector?", there is a more detailed discussion on Kelun Botai's ADC products.

The star product in Kelun Botai's ADC pipeline is SKB264 (generic name: Lukangshatuozhu单抗), and the recent important research and development progress that has been announced includes:

1. On November 27 this year, SKB264 for the treatment of locally advanced or metastatic triple-negative breast cancer (TNBC) was approved for marketing in China;

2. On August 20 this year, the NDA for SKB264 in the treatment of EGFR - TKI and platinum - resistant non - small cell lung cancer (NSCLC) indications was accepted and included in the priority review and approval sequence;

3. On October 31 this year, the NDA for SKB264 in the treatment of EGFR - TKI - resistant NSCLC indications was accepted and also included in the priority review and approval sequence;

From the perspective of the commercialization rhythm, the treatment of TNBC with SKB264 has been approved, and the two indications of SKB264 for the treatment of NSCLC are expected to be approved for marketing in 2025. In addition, the NDAs for A166 (HER2 ADC) and A167 (PD - L1) related indications have also been accepted, and the expected approval and marketing time is also in 2025. Therefore, 2025 will be the beginning of the comprehensive commercialization of Kelun Pharmaceutical's innovative drugs.

Regarding the treatment of TNBC and NSCLC with SKB264, the current market expectations are good. TNBC is one of the most dangerous and difficult subtypes of breast cancer, and there are currently not many good drugs. The approval of SKB264 for marketing fills a market gap, and according to the current clinical data, it has the potential to become BIC, and the pharmacological advantage is the basis for future sales growth.

The treatment status of the two NDAs for SKB264 in the treatment of NSCLC that have been accepted is in the second and third lines. NSCLC is a typical large cancer type, and the market space for second - line treatment is still not small, and the ADC competitors of SKB264 have encountered major setbacks this year. SKB264 also has a certain BIC potential in the field of second - line NSCLC, so the future sales situation is also worth looking forward to.

04 Investment Strategy

As can be seen from the previous discussion, Kelun Pharmaceutical is currently in a special historical stage before the innovative drugs enter the harvest period. With the successive approval of the relevant indications of the innovative drugs and the consolidation of the innovative drug revenue, the income structure of Kelun Pharmaceutical will undergo a relatively large change. Therefore, the current financial information (as of 2024Q3) only includes the existing businesses, mainly the large - volume infusion and antibiotic intermediates, as well as a part of the generic drug business.

In view of the fact that both the large - volume infusion and antibiotic intermediate industries have the characteristics of relatively stable demand, slow market growth, and low competition intensity, and Kelun Pharmaceutical is the leader in these two industries, therefore, based on the above industry logic, the future expectations of Kelun Pharmaceutical's large - volume infusion and antibiotic intermediate businesses are steady growth and reliable performance. The elasticity of antibiotic intermediates in the past mainly relied on cost control, and in the future, it depends on the support of the sales volume of synthetic biological products to the performance.

The current market expectations for Kelun Pharmaceutical's innovative drugs, especially the ADC products, are quite high. On the one hand, the technology itself is relatively new and is one of the core directions of precision medicine in the future. On the other hand, it has shown a certain BIC potential among similar products, and the currently targeted indications also have good commercialization potential. The consolidation of future innovative drug revenue will strongly support the valuation of Kelun Pharmaceutical.

Considering the payment ability of ordinary patients in China, in the commercialization process of innovative drugs after being approved in China, expanding accessibility through medical insurance is the choice of many pharmaceutical companies. However, the suppression of prices after the national medical insurance negotiation also affects the income growth of innovative drugs to a certain extent. Therefore, the incremental income brought by the overseas expansion of innovative drugs will have a significant impact on the expectations of related varieties. For Kelun Pharmaceutical, the overseas expansion of its ADC products through strategic cooperation with Merck, leveraging its resources to develop business overseas, is one of the core points in the medium term.

Looking at the current ADC products from the technical level, the payload is mainly chemotherapy small molecules. Therefore, essentially, the current mainstream ADC can be said to be chemotherapy with targeting function, and it has not fundamentally solved the problem of chemotherapy resistance. It should be noted that the ADC technology platform can not only carry chemotherapy molecules, but also can conjugate tumor immune agonists, PROTAC, nucleic acid compounds, etc. Therefore, the scalability of the future ADC platform and the upgrade and iteration of related technologies are the bigger highlights of this type of drug, which is very important for the future valuation of Kelun Pharmaceutical.

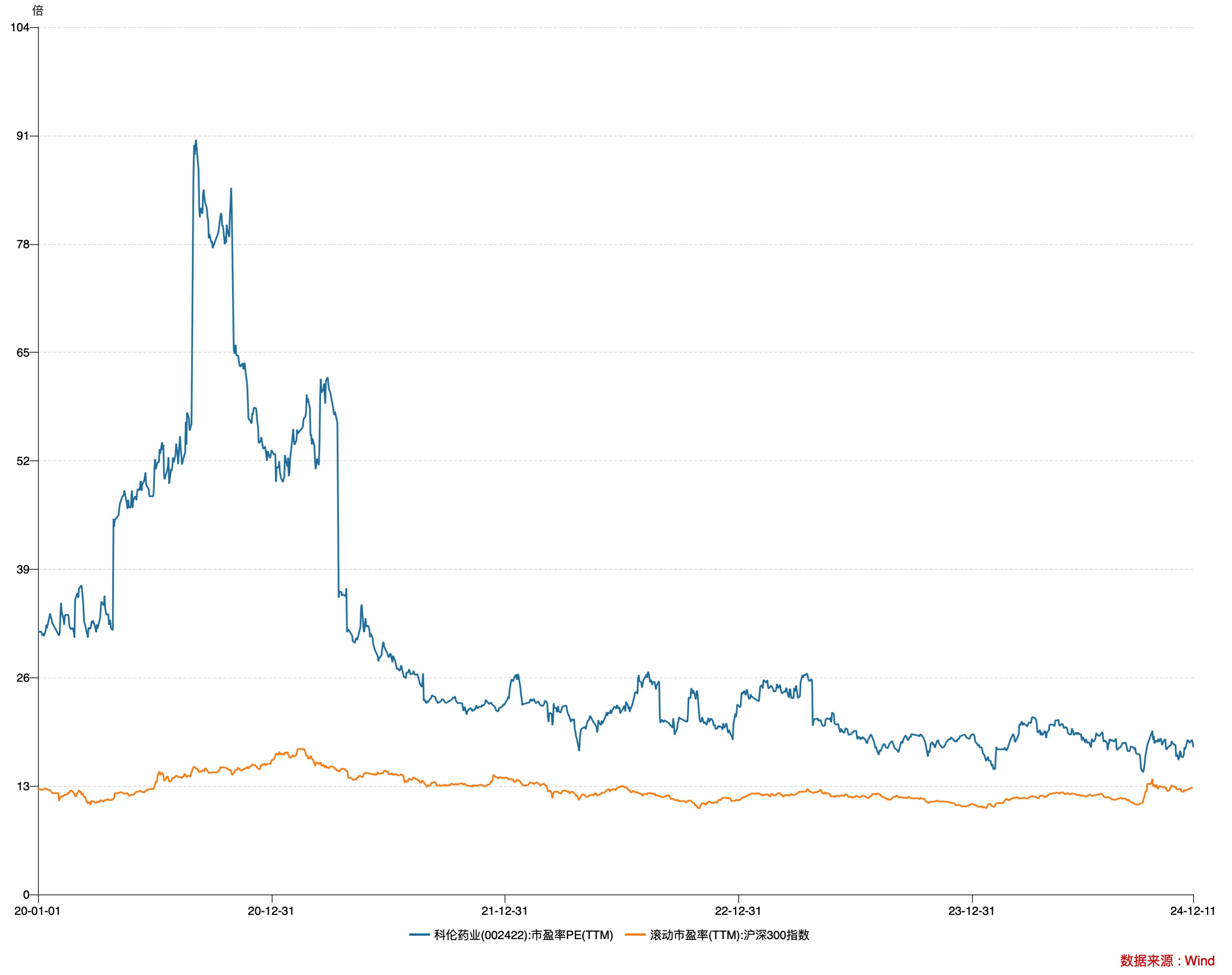

In terms of valuation, even though the stock price of Kelun Pharmaceutical has shown a continuous upward trend in the past three years as a whole, the PE - TTM of Kelun Pharmaceutical in the past year has been below 20 times for a long time. Such a valuation level still does not deviate from the manufacturing category, and the expectations for innovative drugs are obviously underestimated. On the other hand, Kelun Pharmaceutical's existing businesses have a good ability to digest the valuation. After the consolidation of the future innovative drug revenue, with the change in expectations, especially the re - pricing of its scientific and technological components, the upward space of the valuation will also be opened.

Figure: Rolling PE of Kelun Pharmaceutical and CSI 300; Source: Wind, 36Kr

*Disclaimer:

The content of this article only represents the author's views.

The market is risky, and investment needs to be cautious. Under no circumstances does the information in this article or the opinions expressed constitute an investment recommendation for anyone. Before making an investment decision, if necessary, investors must consult a professional and make a cautious decision. We do not intend to provide underwriting services or any services that require a specific qualification or license for trading parties.